In today’s digital world, financial technology (fintech) companies are changing the way people manage their money. Firms like Block, PayPal, and Affirm started with different goals, but they are now moving in the same direction—offering a full range of banking services.

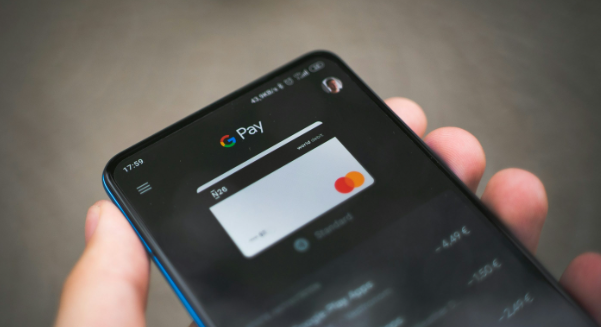

These companies began by solving simple financial problems. Block (formerly known as Square) made it easy for small businesses to accept payments through smartphones. Affirm focused on giving people an alternative to traditional credit cards with its “buy now, pay later” (BNPL) services. PayPal, on the other hand, revolutionized online payments more than 25 years ago by enabling businesses and individuals to send and receive money electronically.

Now, these fintech giants are trying to become all-in-one digital banks. They want to offer services that go beyond just payments—things like savings accounts, investment options, credit and debit services, and even cryptocurrency investments. Their recent earnings reports highlight this growing competition, as each company works toward becoming the go-to financial service provider for digital-first customers.

Fintech Companies Are Expanding Their Services

Each of these fintech companies is trying to provide more financial services to attract customers. Block’s CEO, Jack Dorsey, believes that offering multiple services under one platform is the best way forward. Affirm’s CEO, Max Levchin, shares a similar vision, saying that his company wants to give people an alternative to traditional credit and debit cards.

Even though their earnings reports show different levels of success, all three companies are focusing on digital banking services. They want to replace the need for physical bank branches and allow people to manage their money entirely online.

Block’s Strategy: More Than Just Payments

Block, previously known as Square, first became popular for helping small businesses accept card payments. Over time, it expanded into personal finance by launching services like Cash App, which allows users to send money, receive paychecks, and even invest in Bitcoin.

Recently, Block reported financial results that disappointed investors. The company’s earnings and revenue fell below expectations, leading to an 18% drop in its stock price. Despite this, Jack Dorsey remains confident in the company’s strategy. He stated that Block is successfully transforming from a simple payment platform into a full financial services provider.

Block has also entered the “buy now, pay later” (BNPL) space, which was originally dominated by Affirm. In 2022, Block acquired Afterpay, a major BNPL company, for $29 billion. This move allowed Block to increase its market share in BNPL services, competing directly with Affirm.

Affirm’s Focus on Consumer-Friendly Credit

Affirm started as a company that offered an alternative to credit cards. It allowed customers to purchase products and pay for them later in installments, without hidden fees. Over time, it became one of the biggest players in the BNPL industry.

Affirm’s CEO, Max Levchin, believes that people are looking for better payment options than traditional credit cards. The company continues to focus on providing affordable and flexible payment solutions. Despite growing competition from Block and other fintech firms, Affirm has managed to maintain its position in the market.

According to a report from Mizuho, Block’s market share in BNPL increased to 19%, while Affirm held steady at 17%. This shows that both companies are growing in the BNPL sector, but the competition is getting tougher.

PayPal’s Long-Standing Influence in Digital Payments

PayPal was one of the first companies to make online payments easy and secure. Founded over 25 years ago, it helped millions of businesses accept electronic payments. Over the years, PayPal has added more services, including peer-to-peer money transfers, business loans, and cryptocurrency trading.

Even though newer fintech companies like Block and Affirm are growing rapidly, PayPal remains a strong competitor in the digital banking space. The company continues to innovate by adding new financial services to keep up with changing customer needs.

Why Are Fintech Companies Becoming Digital Banks?

Traditionally, people relied on brick-and-mortar banks for all their financial needs. However, younger generations, such as Millennials and Gen Z, prefer managing their money online. They rarely visit bank branches and prefer financial services that are fast, convenient, and accessible through smartphones.

Fintech companies have noticed this shift and are working hard to replace traditional banks. They want to offer everything a bank does—but in a more user-friendly and digital-first way.

Block’s Chief Financial Officer, Amrita Ahuja, explained that the company sees huge potential in attracting digital-native customers. She believes that Millennials and Gen Z will drive the future growth of digital banking services.